After ‘Unwelcome Convergence,’ Experts Talk Aircraft Market’s Paths to Growth

25 May 2016

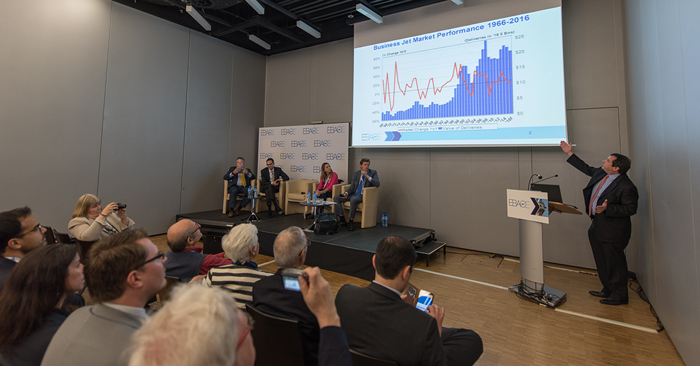

In the last 12 months, the business aviation market has seen an “unwelcome convergence,” said Richard Aboulafia, vice president of analysis at Teal Group, at a State of the Industry education session at the 2016 European Business Aviation Convention & Exhibition (EBACE2016).

“After 2008, the business aircraft market was torn in half,” said Aboulafia. “The ‘big iron’ segment of large cabin aircraft actually did fine because of emerging markets, but the small and midsize segment fell by 57 percent, peak-to-trough.”

The recession in emerging markets has caused a decline in demand for large cabin aircraft, while a healthy economy in North America has spurred pickup in light and midsized jets. In Europe, business aircraft movements have declined four years in a row, and because of the economic slowdown in Russia, Eurocontrol has seen 20 fewer flights a day between Europe and Russia.

“We’ve also seen business aviation decline in Ukraine, for political reasons, and a decline in Turkey,” said Dr. Clair Leleu, forecasting manager at Eurocontrol. “And there’s been lower than expected activity in Switzerland.”

Learning from Europe’s Low-Cost Airlines

The panel, which also brought together Bombardier’s Jean-Christophe Gallagher and Charles Schlumberger from the World Bank, was organized around the theme: “Business as Usual is Not Good Enough.” Moderator Richard Koe, of WINGX Advance, challenged the panel to brainstorm strategies for ensuring long term growth for the industry.

“Europe is not like the U.S.,” said Schlumberger. “In America, you cannot build a business without a plane. In Europe, the distances are shorter, the infrastructure is better and the alternatives are better.”

The panelists focused on what business aviation could learn from the lost-cost airlines. Carriers like Ryan Air and easyJet have grown 6 percent a year in a global economy that’s only grown at 2.5 percent annually, meaning consumers are “making a choice” for air transportation, said Schlumberger.

That in turn has driven up purchases of airliners. The commercial jet liner market has seen an annual growth rate above 9 percent.

“Traffic is not all that’s driving that demand,” said Aboulafia. “High fuel prices were driving replacement of the legacy fleet and cheap commercial credit has enabled airlines to lease aircraft at very low interest rates.”

Lenders tend to not value business aircraft the same way as commercial aircraft, so the panelists discussed easing access to credit, improving business aviation’s competition against other modes of transport in Europe, increasing the pool of potential customers through jet cards and fractional ownership, as well as marketing with a strong productivity message.